This is an informational guide for students not intended to provide professional tax advice. If you have questions or need further assistance, please contact your tax advisor or the Internal Revenue Service (IRS) at https://www.irs.gov/

Frequently Asked Questions (FAQs) about Form 1098-T:

- What is a Form 1098-T and why do I need one?

All eligible educational institutions must file a Form 1098-T to report information to the Internal Revenue Service (IRS) for each qualifying student for whom a reportable transaction is made during the calendar tax year. The 1098-T form that you received is for your use in preparing your federal income tax return. Please note that your 1098-T form may not provide all of the information you need to determine eligibility for tax credits and deductions. Eligibility for any tax benefit depends upon your individual facts and circumstances and the College/District cannot provide you with any tax advice.

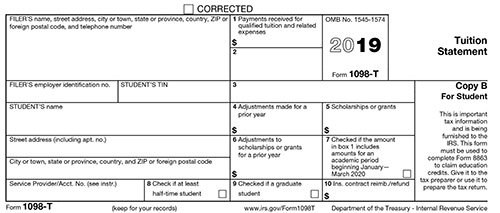

- What does the 1098-T form look like?

Sample:

- What is the deadline for the 1098-T forms to be mailed to students?

The Form 1098-T will be provided by January 31st of each year for the previous calendar year.

- How does this affect my taxes? How much can I deduct from my taxes? Where on my tax form do I put this information?

Your accountant, tax preparer, or the Internal Revenue Service can best advise you in the utilization of this form when preparing your taxes.

- Is this form a bill?

No, it is not a bill nor a request for payment.

- Is this form a source of income that I must include on my tax forms?

No, this form is a statement of the amount of tuition and related expenses paid on your student account in the prior calendar year.

- How is the amount determined?

It will include the amount paid for tuition and related expenses. It includes payments made during the prior calendar year, without regard to the semester the payments apply to. For example, if a payment was made in December 2019 for the Spring semester beginning January 2020, the payment would be included on the 1098-T form for calendar year 2019.

- Who do I contact if I think the information is incorrect?

It is important to remember that the amount on this form consists of charges assessed by the District in a calendar year. Contact the Accounting Office at the District Administrative Center at (805) 652-5590.

- I'm a parent. Can I have my student's 1098-T form sent to me?

Students must make all information requests. The student is responsible for providing information to other parties in accordance with FERPA (Family Education Right to Privacy Act).

- Can I access my 1098-T online?

Yes, you can access your 1098-T online:

- Go to https://heartland.ecsi.net/index.main.html#/access/lookup (select the Tax Documents box if accessing after April 1st)

- Click on “I need my 1098-T Tuition tax statement”

- On the next page, begin typing “VEN” and select “Ventura County Community College District” when it pops up

- Enter personal information as directed to access your 1098-T data

If you cannot access your 1098-T online, please call ECSI Customer Service at 866-428-1098.

- Why is it that I don't have any information on the Form 1098-T or I never received a Form 1098-T in the mail?

Ventura County Community College District is not required to file Form 1098-T or furnish a statement for:

Please login to the student web portal at https://my.vcccd.edu to verify your address and update your contact information.

- If your billed amounts consisted of only non-credit courses, even if the student is otherwise enrolled in a degree program.

- Students whose scholarship and/or financial aid (including formal billing arrangements with employers or governmental agencies, such as the Department of Veteran Affairs or the Department of Defense) exceeded the billed amount.

- International (foreign) students who are not U.S. residents for tax purposes (who have not been in the U.S. less than 5 years)

- Students classified as non-resident aliens.

- If payments were made in previous years for classes taken in the current calendar year, the payments are not reflected in the current tax year. When reviewing your records, please take into consideration actual payment dates (e.g. if you paid for the Spring term (which starts in January) in November, that payment would be on the prior years’ Form 1098-T).

- If you paid for your enrollment fees, but dropped all your classes and received a refund during that calendar year, then you would not receive a Form 1098-T.

- Ventura County Community College District does not have your Social Security Number - this information is required for Form 1098-T reporting (make sure you provide us with this information).

- If your address on record is out-of-date, your Form 1098-T may have been returned.2Why do my records not match the tuition and fee payments reflected on my Form 1098-T?

12. When reviewing your records, please take into consideration actual payment dates in order to reconcile your records in the amounts on the form. The 1098-T form reflects payments and refunds made in the calendar year. Payments made in previous or future years are not included. Payments for the following expenses do not qualify as tuition and related expenses for community colleges: 1) Books; 2) parking permits.

13. Why do I need to provide a valid Social Security Number (SSN) or Individual Tax Identification Number (ITIN)?

If you are a not a U.S. resident and will not be filing taxes with the IRS, you may disregard this notice as you are not required to provide a TIN. In order to comply with IRS regulations, the college must have your correct identifying number to file certain information to the IRS and to furnish a statement (IRS Form 1098-T) to you. Form 1098-T requires either the student's social security number (SSN) or individual tax identification number (ITIN).

Please complete the W9S form, then upload the completed document along with scanned images of your picture ID and social security card or individual tax identification number (ITIN) using our secure form submission website. Per IRS section 6109, failure to furnish a correct SSN or ITIN may result in a $50 penalty from the IRS to you unless the failure is due to a reasonable cause and not to willful neglect.

The social security number you provide will be used to generate IRS Form 1098-T, which helps to reduce your federal tax liability should you qualify for an educational tax credit (see IRS publication 970 at www.irs.gov or call the IRS at 1-800-829-1040 for more information about this form).

For tax information or if you have additional questions or concerns please consult your tax advisor or contact the Internal Revenue Service Center. Visit the IRS website at https://www.irs.gov/